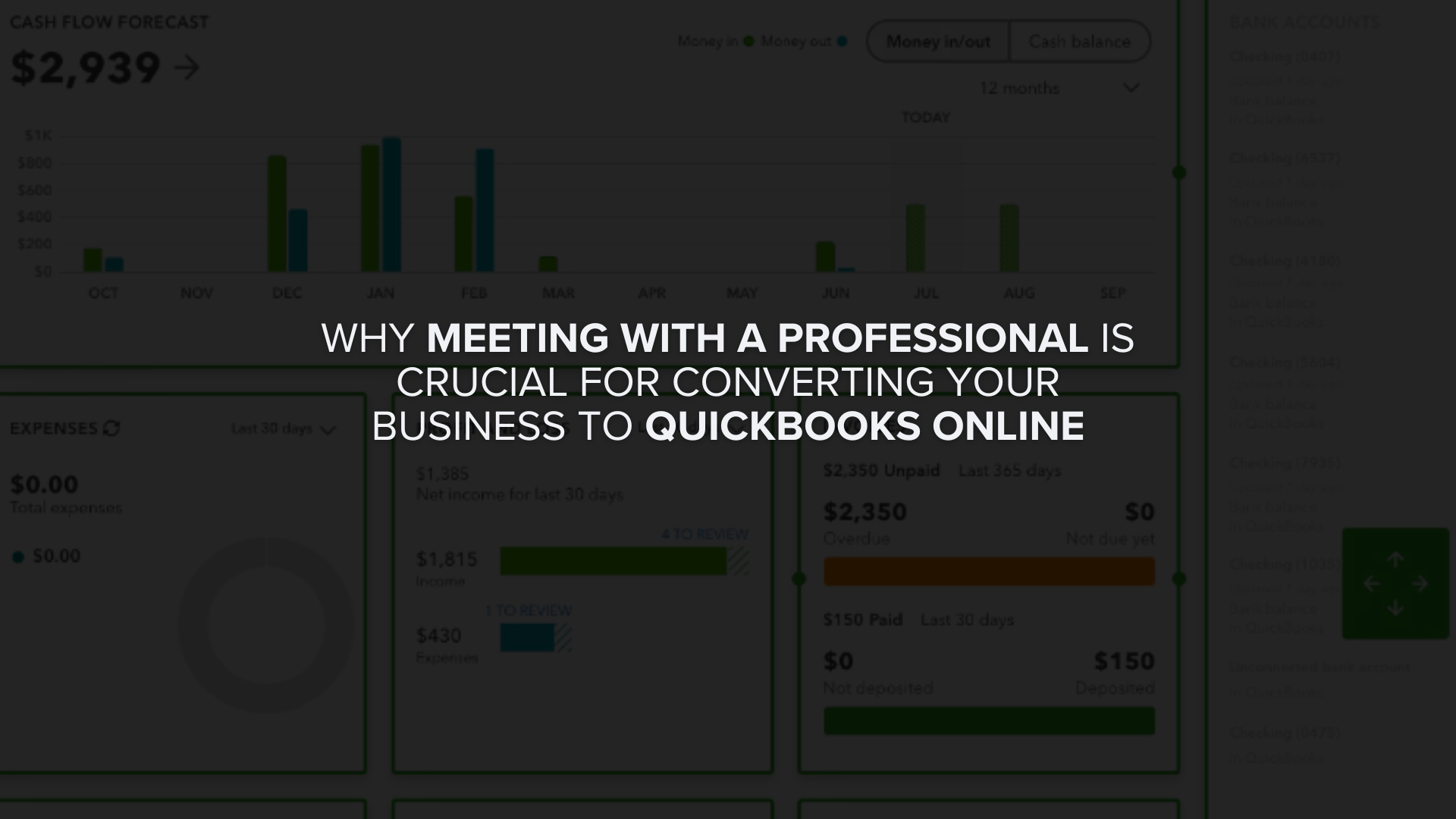

Why Meeting with a Professional is Crucial for Converting Your Business to QuickBooks Online

In today’s fast-paced business environment, efficient financial management is essential and QuickBooks Online (QBO) offers streamlined accounting processes. However, transitioning to QBO requires precision and expertise to avoid costly consequences. At Anthem, we want to emphasize the importance of consulting with a professional to ensure a seamless conversion or have them handle it for you. […]